Reimagining the grid for net zero

We help electric utilities to unlock capacity and solve their critical grid issues.

Talk to our experts

We help our customers unlock capacity and solve their critical grid issues, using our grid enhancing technologies to create a more flexible, reliable and affordable grid. This enables a faster, more cost-efficient path to meet growing energy demand with clean energy generation, at lowest cost to consumers.

High-impact grid enhancing technology and services

SmartValve™

Modular Power Flow Control

SUMO

Dynamic Line Rating

Analytics

Advisory Services

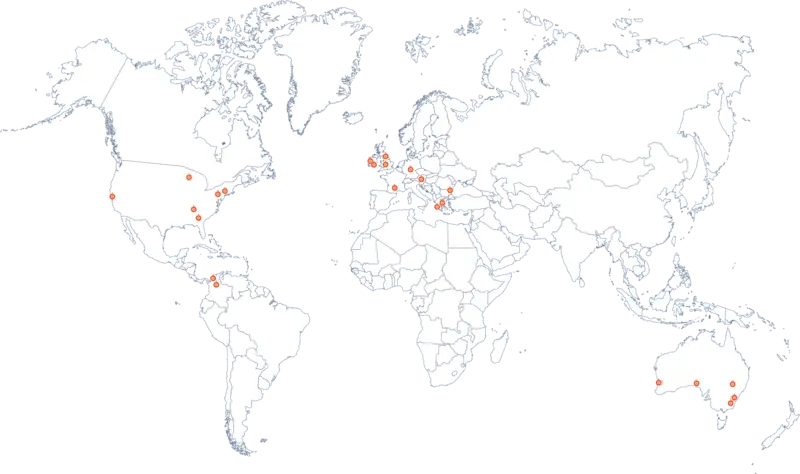

Transforming grids globally

In collaboration with our customers and partners, we’ve successfully deployed our grid enhancing technologies across four continents. This has unlocked over 3.5 Gigawatts capacity—enough to power over 2.5 million homes—and provided operational flexibility to our customers, supporting the faster integration of clean energy and new demand, enhancing security of supply and delivering cost savings to consumers.

Careers

We are a team of over 100 passionate and ambitious experts spread across four continents who work everyday to transform grids globally. Interested in joining us on this mission? Take a look at our open positions

Latest news

Expert insights